Catholic Gift Annuity

What is a Charitable Gift Annuity?

A charitable gift annuity is a simple contract. You make a gift to Catholic Gift Annuity, and in return, you receive fixed payments for life. At your death, the remaining balance of the gift annuity is distributed to the Catholic organization(s) you designated. See how it works below:

01

Fixed-rate annuity payments for life

02

Immediate & future tax benefits

03

Payment schedule tailored to your needs

04

A lasting legacy of your support for Catholics in SC

What are the benefits?

1. Receive fixed payments for life; a portion of these payments are tax free.

2. Receive an income tax deduction for a portion of your gift, as allowable by IRS rules.

3. Join a pool of thousands of Catholics in a financially strong program that helps the Catholic Church.

4. Feel satisfied in making a significant gift that benefits you now and the Catholic organization(s) of your choice for future generations.

What are the features?

1. Secure, convenient deposit of payments into your preferred bank account.

2. Three types of annuities to select from (rates vary):

1) Immediate One Life

2) Immediate Two Lives - Two recipients

3) Deferred - Start payments later

3. The Catholic Gift Annuity program combines your gift with others from across the U.S. to increase the impact of your generosity.

4.

The

minimum amount

to establish a gift annuity is

$5,000 and the

minimum age

to receive income is

55 years old.

FAQs:

Are the payments guaranteed?

Catholic Gift Annuity payments are made from a segregated pool with adequate reserves to meet statutory requirements. Payment obligations are also backed by Catholic Extension Society’s unrestricted net assets of over $100 million.

Catholic Extension Society has not missed an annuity payment for over 100 years of the program. A copy of our annual audited financial statements is available upon request.

What if the donor does not need the income anymore?

The donor can revoke all future payments at any time and the remainder of the annuity amount would go to benefit the Catholic organization designated at the time of the initial gift. Additional tax benefits may apply when revoking your annuity. A tax advisor would be able to provide guidance.

What should the donor be aware of before taking out a Catholic Gift Annuity?

The donor should know it is an irrevocable gift and is not an investment vehicle. A copy of the disclosure statement should be available.

Does the donor receive a charitable deduction?

The donor may be eligible to receive charitable tax deduction the year the gift is made. A tax advisor would be able to provide guidance.

Can the donor add funds to an annuity to receive a larger payout?

Since an annuity is a contract, and is irrevocable, additional funds cannot be added. However, the donor can establish an additional annuity and have the payments made on the same schedule.

What is a two lives annuity contract?

The two lives contract is typically a husband and wife, but it could be two siblings or two friends, etc. Beneficiaries must be at least 55 at the time payments begin. The rate is a blend based on the ages of both annuitants and their life expectancy as recommended by the ACGA. Fixed payments continue as long as either annuitant is alive.

Can the donor transfer the payments to their children?

No, distributions are payable only to the annuitant.

Can a donor establish an annuity for another person, such as a spouse or child?

Yes, a donor can establish a “for the benefit of” annuity contract naming another person as beneficiary. The beneficiary must be at least 55 years old at the time payments begin. Gift tax rules may or may not apply. A tax advisor would be able to provide guidance.

What is a deferred annuity contract?

A deferred annuity contract allows payments to begin at the age of 55 or some point in the future. The rate as recommended by the ACGA is higher than immediate payment contracts.

This type of gift can be very attractive to donors who are in their peak earning years and may benefit from a charitable tax deduction now and are looking for stable source of income in the future.

What is the 10% Catholic Gift Annuity Reserve for?

The 10% will be retained in the segregated pool to build reserves to meet state regulatory requirements as well as offset potential longevity and investment risk associated with issuing annuities.

Establish a Catholic Gift Annuity and create a legacy that lasts a lifetime!

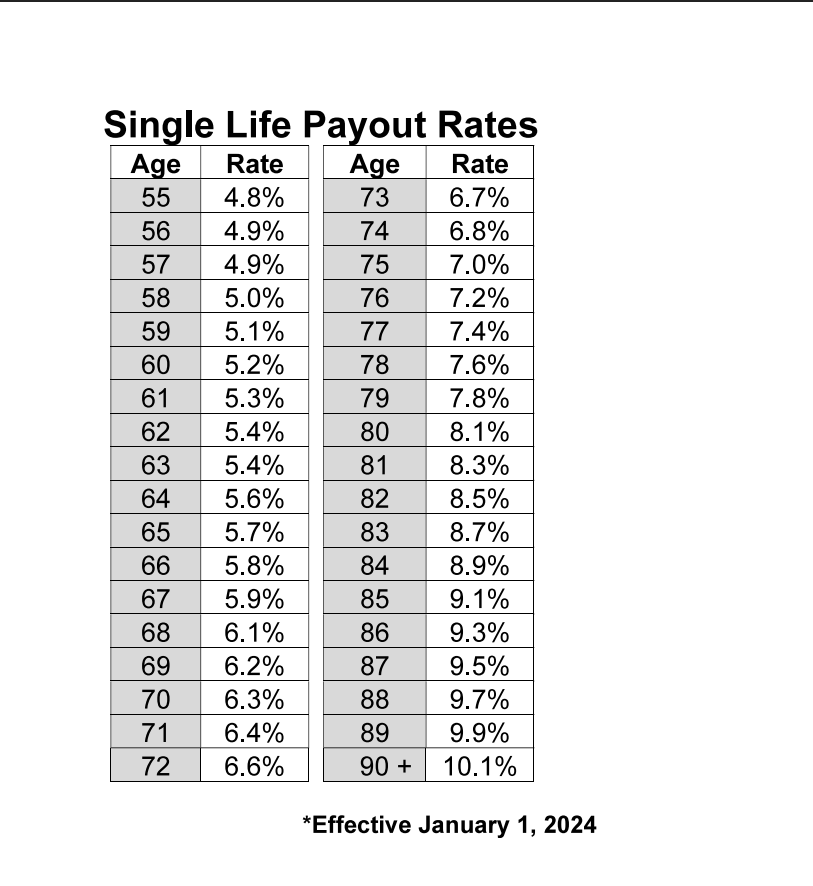

The Catholic Gift Annuity program follows the suggested payout rates by the American Council on Gift Annuities. Rates and more information can be found at www.catholicgiftannuity.org.

Catholic Gift Annuity is administered by Catholic Extension Society, which has been providing charitable gift annuities since 1912. Catholic Extension Society provides this service to support people, infrastructure and ministries of your diocese and others across the United States. To maintain financial strength of this program’s reserves, Catholic Extension Society may retain up to 10% of the amount to be distributed to Catholic organization(s). For more information visit: www.catholicextension.org